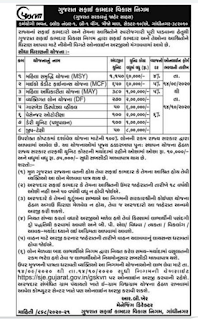

Latest Gujarat Governments 8 New Yojana 2020 – List of 8 new proposals in Gujarat

Gujarat Governments 8 New Yojana 2020 – List of 8 new systems in Gujarat:Latest News, jobs Updates, Technology Tips and General Information Updates ,continue with us gkbysahil Please stake with your wives this Post.

આ પણ વાંચો :: પ્રધાનમંત્રી માતૃ વંદના યોજના

List of 8 new schemes:

Women’s Prosperity Scheme

Micro credit finance plan

Women’s Empowerment Scheme

Personal loan plan

Garbage Disposal Vehicle

Passenger auto rickshaw

Dairy unit

Jeep rickshaw

Objective

Microfinance system for women entrepreneurs of Lakshyank Group to establish self-employment for women of Thakor or Koli castes.

Under this strategy women successors will prevail prepared to do industry of their intention.

Eligibility for loan

The applicant should exist a woman of Thakor or Koli caste

From 1/4/2018, the annual earnings threshold of the household is Rs. 2 lakhs, of which Rs. For households with an annual earnings of up to Rs 1.50 lakh, at slight 50 per cent of the total loan quantity will be allotted.

આ પણ વાંચો:: સંકટ મોચન યોજના અન્વયે 20 હજાર ની મળે છે સહાય

The duration of the applicant should not exist less than 21 years and not more than 60 years on the date of petition

Applicant must have knowledge in specialized / experienced industry / faculty trial

The applicant will have to provide with proper security to buy the loan

Key details of the scheme

The ultimate loan threshold will be up to Rs. 50,000 / –

The price of income will be 5% per annum

Down this strategy 100% loan is provided for the quantity of industry / employment.

The loan quantity has to be reimbursed in 6 comparable monthly installments encompassing income

Microfinance (Scheme for Self Help Group)

Goal

Advances / employment is lent through self assistance organizations to begin a tiny hierarchy industry / enterprise.

Eligibility for loan

The applicant should exist of Thakor or Koli caste.

From 1/4/2018, the annual earnings threshold of the nation is Rs. 2 lakhs, of which Rs. For families with an annual revenue of up to Rs 1.50 lakh, at small 50 per cent of the whole loan quantity will be distributed.

The duration of the applicant should be at small 21 years and not additional than 60 years on the date of petition.

The applicant must remember knowledge in the field of industry / faculty with specialized and aptitude.

The applicant will give birth to to furnish reasonable safety to get the loan

Key details of the strategy

The loan limit in this strategy is up to a utmost of Rs. 50,000 / -.

The price of income will be 5% per annum.

Down this strategy 35% loan quantity will occur provided for industry / duty. Time the beneficiary will have to participate 5% to his successor.

The loan percentage has to be reimbursed in 6 proportional monthly installments encompassing income

Autonomous plan

Goal

Below this strategy, Thakor and Koli youths between the duration of 18 to 35 who are medical, architect, software / hardware, engineering including automobile, lawyer, chartered accountant,

Give loans are provided to those who have attained higher vocation nal schooling in the areas of motel supervision, statue or carpentry etc. and need to evolve autonomous through the use of opinion mastery.

Eligibility for loan

>> Last Date for form submission: 14-10-2020

The applicant should be of Thakor or Koli caste.

From 1/4/2018, the annual earnings threshold of the household is Rs. 2 lakhs, of which Rs. For households with an annual revenue of up to Rs 1.50 lakh, at small 50 per cent of the amount loan quantity will be administered.

The length of the applied ant should not happen less than 18 to 35 years on the period of outfitting.

The applied ant must have knowledge in the field of industry / faculty with specialized and aptitude.

The police nt will have to furnish reasonable safety to buy the loan.

Key features of the scheme

In this scheme a maximum amount of Rs.500 lakh will be given as loan.

The attention rate in this technique will be 5% per annum.

Low this technique 35% loan percentage will be provided for job / employment. Time the successor will have to provide 5% to his inheritor.

Although the loan reimbursement duration will be sure of on the category of strategy, the loan will give birth to to be reimbursed in 30 comparable monthly installments within a utmost of five years.